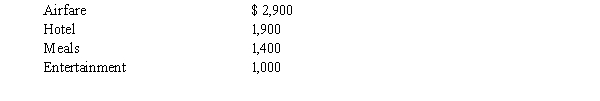

Mathew works for Levitz Mortgage Company. The company has an accountable reimbursement plan. During the year Levitz reimburses Mathew $5,400 for his business expenses. Mathew's adjusted gross income for the year is $45,000. His business expenses are as follows:  What amount will Mathew be able to deduct as a miscellaneous itemized deduction?

What amount will Mathew be able to deduct as a miscellaneous itemized deduction?

A) $ - 0 -

B) $ 600

C) $1,200

D) $1,500

E) $1,800

Correct Answer:

Verified

Q84: Charlie is single and operates his barber

Q89: Margaret is single and is a self-employed

Q93: Chelsea is an employee of Avondale Company.

Q94: Oliver owns Wifit, an unincorporated sports store.

Q95: Kyle is married and a self-employed landscaper.

Q97: Darlene and Devin are married. Darlene earns

Q100: Brees Co. requires its employees to adequately

Q101: Mollie is single and is an employee

Q102: Victor is single and graduated from Wabash

Q103: Dan and Dawn are married and file

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents