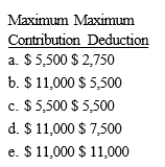

Marshall and Michelle are married with salaries of $80,000 and $64,000, respectively. Their combined AGI is $181,000. Michelle is an active participant in her company's qualified pension plan while Marshall is not. Determine the maximum combined IRA contribution and deduction amounts?

Correct Answer:

Verified

Q107: Margie is single and is an employee

Q109: Martha is single and graduated from Ivy

Q112: Kevin,single,is an employee of the Colonial Company

Q112: Hector is a 54-year-old head of household

Q113: Fred and Flossie are married and their

Q114: Karen is single and graduated from Marring

Q115: James has three nieces, ages 11, 16,

Q116: Phil and Faye are married and have

Q117: Carl, age 59, and Cindy, age 49,

Q118: Carlos is single and has a 7

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents