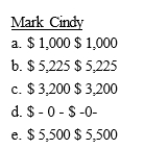

Mark and Cindy are married with salaries of $45,000 and $42,000, respectively. Adjusted gross income on their jointly filed tax return is $97,000. Both individuals are active participants in employer provided qualified pension plans. What is the maximum amount each person may deduct for AGI with regard to IRA contributions?

Correct Answer:

Verified

Q84: Charlie is single and operates his barber

Q100: Brees Co. requires its employees to adequately

Q101: Mollie is single and is an employee

Q102: Victor is single and graduated from Wabash

Q103: Dan and Dawn are married and file

Q105: Homer and Marge are married and have

Q106: Arturo and Josephina are married with salaries

Q107: Margie is single and is an employee

Q109: Martha is single and graduated from Ivy

Q118: Carlos is single and has a 7

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents