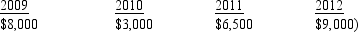

Billingsworth Corporation has the following net capital gains and losses for 2009 through 2012. Billingsworth' marginal tax rate is 34% for all years.  In 2013, Billingsworth Corporation earned net operating income of $30,000. What is/are the tax effects) of the $9,000 net capital loss in 2012? I. Corporate taxable income is $21,000. II. The net capital loss will provide income tax refunds totaling $3,060. Only statement I is correct. Only statement II is correct. Both statements are correct. Neither statement is correct.

In 2013, Billingsworth Corporation earned net operating income of $30,000. What is/are the tax effects) of the $9,000 net capital loss in 2012? I. Corporate taxable income is $21,000. II. The net capital loss will provide income tax refunds totaling $3,060. Only statement I is correct. Only statement II is correct. Both statements are correct. Neither statement is correct.

Correct Answer:

Verified

Q62: Which of the following losses are generally

Q70: Which of the following events is a

Q71: In April of the current year, Speedy

Q71: Aunt Bea sold some stock she purchased

Q73: Mario's delivery van is completely destroyed when

Q74: Which of the following events is a

Q75: During the current year, Terry has a

Q77: Ford's automobile that he uses 100% for

Q78: Jennifer's business storage shed is damaged by

Q79: In addition to his salary, Peter realizes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents