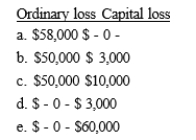

Rosanna, a single taxpayer, owns 2,000 shares of qualifying small business stock that she purchased for $225,000. During the current year, she sells 800 of the shares for $30,000. If this is the only stock Rosanna sells during the year, what can she deduct as an ordinary and capital loss?

Correct Answer:

Verified

Q61: Melinda and Riley are married taxpayers. During

Q63: Frasier sells some stock he purchased several

Q65: Which of the following is true concerning

Q65: During the current year, Schmidt Corporation has

Q71: Aunt Bea sold some stock she purchased

Q71: In April of the current year, Speedy

Q72: Gomez, a self-employed consultant, is involved in

Q73: Mario's delivery van is completely destroyed when

Q79: In addition to his salary, Peter realizes

Q80: Roscoe and Amy are married and own

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents