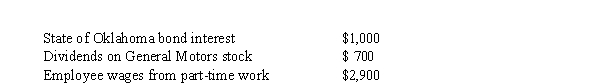

Kevin wants to know if he can claim his brother, Richard, as a qualifying relative for income tax purposes. Richard is 18 and is a part-time student at City Community College. He lives with Kevin in his home for the entire tax year. Kevin provides the majority of Richard's support. During the year Richard has the following items of income:  Can Kevin claim his brother Richard as a dependent for income tax purposes?

Can Kevin claim his brother Richard as a dependent for income tax purposes?

A) Yes.

B) No, Richard fails the relationship test.

C) No, Richard fails the gross income test.

D) No, Richard fails the student test.

E) No, Richard fails the residency test.

Correct Answer:

Verified

Q21: In October of the current year, Brandy

Q22: Simone and Fillmore were divorced last year.Fillmore

Q24: To be a qualifying relative, an individual

Q26: Lilly and her husband Ben have a

Q28: Lillian and Michael were divorced last year.Michael

Q32: Which of the following will prevent a

Q33: Which of the following individuals can be

Q34: Which of the following individuals can be

Q37: During the current year, his three children,

Q38: Rosa is a single parent who maintains

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents