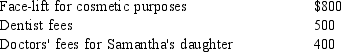

Samantha incurs the following medical expenses for the current year:  How much may Samantha include as qualified medical expenses on her current tax return before any limitation?

How much may Samantha include as qualified medical expenses on her current tax return before any limitation?

A) $ 400

B) $ 500

C) $ 900

D) $1,300

E) $1,700

Correct Answer:

Verified

Q44: Irene is 47 years old, unmarried, and

Q47: Bruce, 65, supports his mother who lives

Q48: Anita receives a state income tax refund

Q49: During the current year, Robbie and Anne

Q51: Georgia is unmarried and maintains a home

Q52: Paul, age 40 and single, has an

Q53: Carlos incurs the following medical expenses during

Q54: Morris is a single individual who has

Q59: Which of the following qualify for the

Q60: Which of the following qualify for the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents