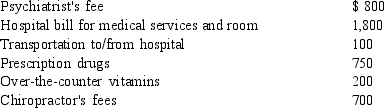

Marci is single and her adjusted gross income is $30,000. In addition, she pays the following expenses during the year:  Marci pays $600 for medical insurance premiums and receives a reimbursement of $1,000 from the insurance company for her medical expenses. Compute her medical deduction.

Marci pays $600 for medical insurance premiums and receives a reimbursement of $1,000 from the insurance company for her medical expenses. Compute her medical deduction.

A) $ - 0 -

B) $ 550

C) $ 750

D) $ 1,250

E) $ 1,450

Correct Answer:

Verified

Q43: Julian and Judy divorced and Julian received

Q53: Carlos incurs the following medical expenses during

Q54: Morris is a single individual who has

Q56: Richard pays his license plate fee for

Q59: Which of the following qualify for the

Q59: Ricardo pays the following taxes during the

Q60: Tisha's husband died in 2011. She has

Q61: Homer has AGI of $41,500, and makes

Q70: Which of the following taxes is deductible

Q70: Linc,age 25,is single and makes an annual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents