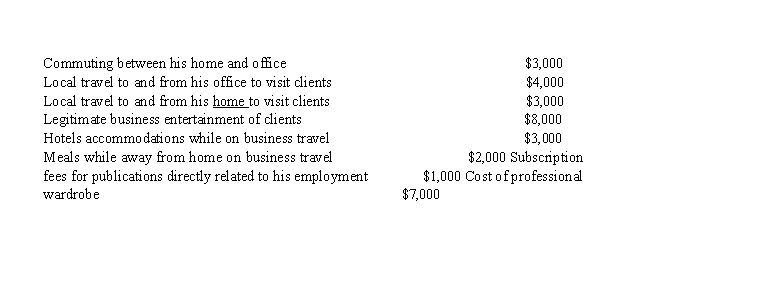

Julius is an employee of a large consulting firm. During the year he incurs the following expenses in his job, none of which are reimbursed by his employer. Julius's adjusted gross income is $100,000 before considering these expenses.  What is Julius's miscellaneous itemized deduction?

What is Julius's miscellaneous itemized deduction?

A) $14,000

B) $16,000

C) $21,000

D) $22,000

E) None of the above

Correct Answer:

Verified

Q82: Smokey purchases undeveloped land in 1999 for

Q88: Sophia, single, is a employee of JWH

Q89: During 2014, Stephanie earns $2,700 from a

Q90: Moran pays the following expenses during the

Q91: Erin is 67, single and has an

Q93: Children under 18 and full time students

Q95: Robbie is 18, and a dependent on

Q96: Velma is 16. Her income consists of

Q97: Barney's sailboat is destroyed in an unusual

Q97: Toby, a single taxpayer with no dependents,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents