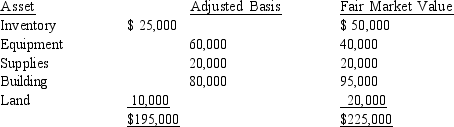

John purchases all of the common stock of Clarke Corporation for $280,000. The assets of the corporation are:  What is John's basis in the common stock he acquired?

What is John's basis in the common stock he acquired?

A) $195,000

B) $215,000

C) $225,000

D) $250,000

E) $280,000

Correct Answer:

Verified

Q10: Intangible property lacks a physical existence; the

Q22: Determine the year-end adjusted basis of Roberto's

Q26: Which of the following is/are adjustment(s) to

Q26: Determine the proper classifications) of a house

Q27: Nanci purchases all of the assets of

Q28: Lu is interested in purchasing the assets

Q30: Harold purchases land and a building by

Q30: Buffey operates a delivery service. She purchased

Q35: David pays $35,000 cash and issues a

Q40: Mary pays $25,000 and secures a mortgage

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents