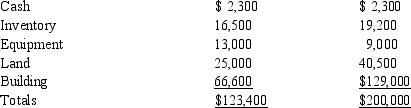

Courtney is interested in purchasing The Matrix Company. Matrix's assets are: Adjusted Basis Fair Market Value  I. If Courtney buys the stock of The Matrix for $225,000, the total basis in the assets will be $200,000. II. If Courtney pays Matrix $240,000 for the Matrix assets, Courtney's total basis in all of the assets of the business will be $123,400.

I. If Courtney buys the stock of The Matrix for $225,000, the total basis in the assets will be $200,000. II. If Courtney pays Matrix $240,000 for the Matrix assets, Courtney's total basis in all of the assets of the business will be $123,400.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Q24: Tien purchases an office building for $400,000,

Q29: Makemore Company purchases a factory for $800,000.

Q32: Juan and Dorothy purchase a new residence

Q33: Morrris, an attorney, performs 5 hours of

Q36: Janet is the business manager for Greenville

Q38: Determine the proper classifications) of a house

Q39: Oscar buys a 10% interest in Britanny

Q40: Sammy buys a 20% interest in Duvall

Q41: On June 10, 2013, Wilhelm receives a

Q42: Rosie inherits 1,000 shares of Northern Skies

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents