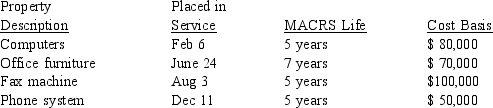

The Anderson Accounting Firm places the following property in service during the 2014 tax year:  Anderson wants to obtain the maximum possible first year depreciation deduction for these property acquisitions including full utilization of the election to expense property under Section 179. Anderson will report 2014 taxable income in the amount of $20,000 before consideration of depreciation on their 2014 property acquisitions. What is the maximum combined amount of cost recovery expense that may be obtained under this set of fact circumstances?

Anderson wants to obtain the maximum possible first year depreciation deduction for these property acquisitions including full utilization of the election to expense property under Section 179. Anderson will report 2014 taxable income in the amount of $20,000 before consideration of depreciation on their 2014 property acquisitions. What is the maximum combined amount of cost recovery expense that may be obtained under this set of fact circumstances?

A) $28,001

B) $56,003

C) $150,000

D) $170,001

E) $178,001

Correct Answer:

Verified

Q71: Tucker Estates places an apartment building in

Q72: On August 3, 2014, Yang purchases office

Q73: Chestnut Furniture Company purchases a delivery van

Q74: Jim places a new lift truck 7-year

Q76: During 2014, Duncan Company purchases and places

Q77: On July 17, 2014, Elise purchases office

Q78: Why might a taxpayer elect to depreciate

Q78: Greenville Floral places a new tractor 7-year

Q79: The Reed CPA Firm places the following

Q80: During 2014, Williams Company purchases and places

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents