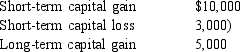

William has the following capital gains and losses for the current year:  What is William's net capital gain or loss position for the year?

What is William's net capital gain or loss position for the year?

A) Short-term capital gain $7,000; Long-term capital gain $5,000.

B) Short-term capital gain $10,000; Long-term capital gain $2,000.

C) Short-term capital gain $7,000; Long-term capital gain $2,000.

D) Short-term capital gain $10,000; Long-term capital gain $5,000

Correct Answer:

Verified

Q1: Allie, a well-known artist, gave one of

Q12: Brock exchanges property with an adjusted basis

Q13: A buyer's assumption of the seller's debt

Q15: Drew traded his office copier in for

Q18: Section 1245 property is subject to a

Q25: Corky receives a gift of property from

Q26: Virginia and Dan each own investment realty

Q26: Melissa sells stock she purchased in 2004

Q30: A capital asset includes which of the

Q33: All of the following are capital assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents