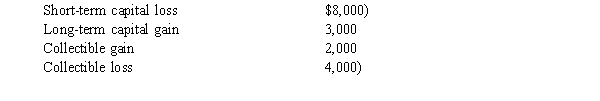

Serenity has the following capital gains and losses for the current year:  If Serenity is single and has taxable income from other sources of $75,000, what is the impact of her capital gains and losses on her income tax liability?

If Serenity is single and has taxable income from other sources of $75,000, what is the impact of her capital gains and losses on her income tax liability?

A) $ 690 decrease.

B) $ 750 decrease.

C) $ 840 decrease.

D) $1,050 decrease.

E) $1,960 decrease.

Correct Answer:

Verified

Q26: Melissa sells stock she purchased in 2004

Q28: Terry receives investment property from her mother

Q29: When her property was fully depreciated and

Q30: A capital asset includes which of the

Q30: Brenda sells stock she purchased in 2004

Q31: Cathy owns property subject to a mortgage

Q32: Joyce receives investment property from her mother

Q33: All of the following are capital assets

Q33: In July 2014, Hillary sells a stamp

Q34: In September 2014, Eduardo sells stock he

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents