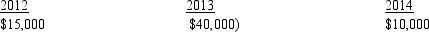

Phi Corporation had the following capital gains and losses for 2012 through 2014:  I. Phi can deduct a loss of $15,000 in 2014. II. Phi will carry forward a $15,000 capital loss to 2015.

I. Phi can deduct a loss of $15,000 in 2014. II. Phi will carry forward a $15,000 capital loss to 2015.

A) Only statement I is correct.

B) Only statement II is correct.

C) Both statements are correct.

D) Neither statement is correct.

Correct Answer:

Verified

Q42: Raymond,a single taxpayer,has taxable income of $155,000

Q50: Sybil purchased 500 shares of Qualified Small

Q51: Rachael purchased 500 shares of Qualified Small

Q52: The exclusion of a percentage of the

Q55: Pamela purchased 500 shares of Qualified Small

Q56: Dwight,a single taxpayer,has taxable income of $75,000

Q56: Cheryl purchased 500 shares of Qualified Small

Q57: Victor bought 100 shares of stock of

Q58: The exclusion of a percentage of the

Q58: A taxable entity has the following capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents