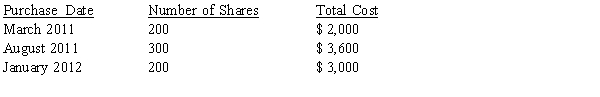

Sally owns 700 shares of Fashion Styles Clothing common stock. Sally purchased the 700 shares as follows:

As of December 29, 2014, Sally has not sold any securities. She needs to send a tuition payment of $5,200 to her daughter's boarding school in Zurich before year-end. Since the Fashion Styles Clothing stock is selling for $13 per share, Sally plans to dispose of 400 shares to cover the tuition. Ignoring commissions and transaction costs, what is the optimal tax result of selling 400 shares?

As of December 29, 2014, Sally has not sold any securities. She needs to send a tuition payment of $5,200 to her daughter's boarding school in Zurich before year-end. Since the Fashion Styles Clothing stock is selling for $13 per share, Sally plans to dispose of 400 shares to cover the tuition. Ignoring commissions and transaction costs, what is the optimal tax result of selling 400 shares?

A) $- 0 - gain or loss.

B) $200 long-term capital loss.

C) $100 long-term capital gain.

D) $800 long-term capital loss

E) $800 long-term capital gain

Correct Answer:

Verified

Q40: In July 2014, Harriet sells a stamp

Q41: A taxable entity has the following capital

Q43: Santana purchased 200 shares of Neffer, Inc.

Q44: Omicron Corporation had the following capital gains

Q46: When securities are sold and the securities

Q50: Sybil purchased 500 shares of Qualified Small

Q52: Capital gain and loss planning strategies include

I.the

Q53: Sidney,a single taxpayer,has taxable income of $45,000

Q55: Pamela purchased 500 shares of Qualified Small

Q56: Dwight,a single taxpayer,has taxable income of $75,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents