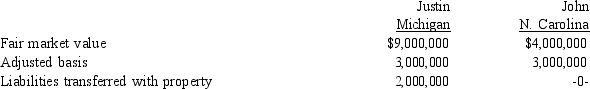

Justin trades an office building located in Michigan to John for an apartment complex located in North Carolina. Details of the two properties:

In addition, John pays Justin $3,000,000 cash as part of this transaction. What is the gain loss) recognized by John in this transaction and what is his basis in the Michigan property?

In addition, John pays Justin $3,000,000 cash as part of this transaction. What is the gain loss) recognized by John in this transaction and what is his basis in the Michigan property?

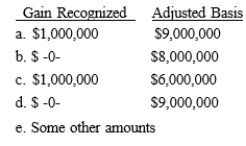

Correct Answer:

Verified

Q43: Roscoe receives real estate appraised at $200,000

Q47: Roscoe receives real estate appraised at $200,000

Q48: Rosilyn trades her old business-use car with

Q49: Norman exchanges a machine he uses in

Q53: Rosilyn trades her old business-use car with

Q54: Lindsey exchanges investment real estate parcels with

Q55: Grant exchanges an old pizza oven from

Q58: Roscoe receives real estate appraised at $200,000

Q59: Cindy exchanges investment real estate with Russell.

Q65: Natural Power Corporation owns a warehouse with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents