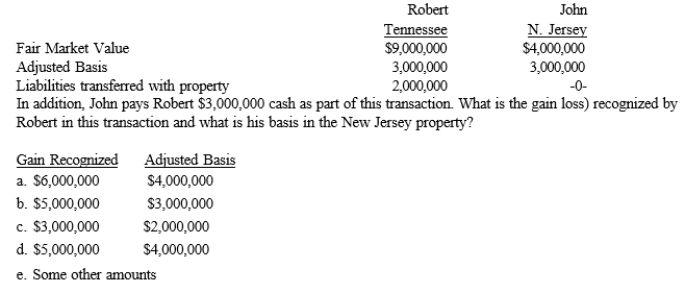

Robert trades an office building located in Tennessee to John for an apartment complex located in New Jersey. Details of the two properties:

Correct Answer:

Verified

Q26: Rationale for nonrecognition of property transactions exists

Q35: No taxable gain or loss is recognized

Q38: The general mechanism used to defer gains

Q42: Norman exchanges a machine he uses in

Q44: Matthew exchanges an investment apartment building for

Q45: Rosilyn trades her old business-use car with

Q46: Grant exchanges an old pizza oven from

Q46: Belinda exchanges investment real estate with Russell.

Q51: Rosilyn trades her old business-use luxury car

Q52: Rebecca trades in her four-wheel drive truck

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents