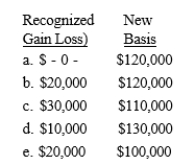

Daisy's warehouse is destroyed by a tornado. The warehouse has an adjusted basis of $130,000 when destroyed. Daisy receives an insurance reimbursement check for $150,000 and immediately reinvests $120,000 of the proceeds in a new warehouse. What are Daisy's recognized gain or loss) and her basis in the replacement warehouse?

Correct Answer:

Verified

Q60: Violet exchanges investment real estate with Russell.

Q64: Which of the following is/are correct regarding

Q65: Natural Power Corporation owns a warehouse with

Q66: Which of the following qualify as replacement

Q67: Which of the following is/are correct concerning

Q68: A flood destroys Owen's building that cost

Q73: Which of the following is/are correct regarding

Q78: If related parties complete a qualified like-kind

Q80: Which of the following is/are correct concerning

Q80: Norm acquired office equipment for his business

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents