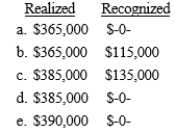

Tony and Faith sell their home for $495,000, incurring selling expenses of $25,000. They purchased the residence for $85,000 and made capital improvements totaling $20,000 during the 20 years they lived there. What is their realized gain and recognized gain on the sale?

Correct Answer:

Verified

Q85: Charlotte purchases a residence for $105,000 on

Q87: Drake and Cynthia sell their home for

Q91: Donald and Candice sell their home for

Q103: Mavis is a schoolteacher with an annual

Q105: Benito owns an office building he purchased

Q106: A flood destroys Franklin's manufacturing facility. The

Q107: Discuss the concepts underlying the determination of

Q109: A fire destroys David's business building that

Q116: Discuss the type of property that is

Q117: Iris' personal residence, located in a plush

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents