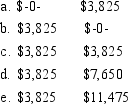

Foster owns 27% of the Baxter Corporation, whose ordinary income is $100,000. His salary for the year is $50,000. What amount must Foster pay in Social Security taxes if Baxter is an) Corporation S Corporation

Correct Answer:

Verified

Q42: Leonor is the financial vice-president and owns

Q46: Jack owns a 50% interest in the

Q52: Carlos is the contoller for Rooney Corporation.

Q53: Sergio and Chris agree to combine their

Q55: Maria owns 30% of the stock of

Q57: Carlotta is the director of golf for

Q61: Nick and Rodrigo form the NRC Partnership

Q62: Winston is the sole shareholder of Winston

Q67: Zeppo and Harpo are equal owners of

Q80: Dewey and Louie agree to combine their

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents