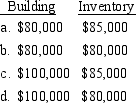

Dewey and Louie agree to combine their sole proprietorships into one business. They will be equal partners in the Dewlou Diner. Dewey will contribute a building worth $100,000 adjusted basis of $80,000), and $10,000 in cash. Louie will contribute inventory worth $80,000 adjusted basis of $85,000) and $30,000 cash. What is Dewlou's basis in the assets?

Correct Answer:

Verified

Q62: Which of the following taxable years are

Q66: Nigel and Frank form NFS, Inc. an

Q68: Which of the following statements regarding a

Q76: Zeppo and Harpo are equal owners of

Q77: Doug, Kate, and Gabe own Refiner Group,

Q78: Snoopy Corporation, Garfield Corporation, and Dogbert Corporation

Q82: Martina, an unmarried individual with no dependents,

Q93: Discuss what limited liability means. What type

Q99: Which of the following businesses can use

Q99: Franco and Melanie start a new business

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents