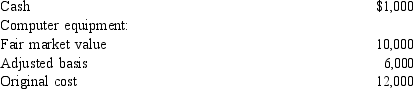

During 2014, Mercedes incorporates her accounting practice. Mercedes is the sole shareholder. The following assets are transferred to the corporation:  What is the corporation's total basis in all of the transferred assets?

What is the corporation's total basis in all of the transferred assets?

A) $6,000

B) $7,000

C) $10,000

D) $11,000

E) $13,000

Correct Answer:

Verified

Q62: Which of the following taxable years are

Q63: Nick and Rodrigo form the NRC Partnership

Q65: Dogg Corporation, Katt Corporation, and Rabitt Corporation

Q67: Clark Exploration Corporation was organized and began

Q68: Which of the following statements regarding a

Q72: On January 5, 2014, Mike acquires a

Q74: A fiscal year can be

I.a period of

Q75: Nigel and Frank form NFS, Inc. an

Q78: Milo contributes a building with a fair

Q80: A new corporation's choice for its annual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents