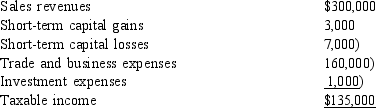

Luisa, Lois, and Lucy operate a boutique named Mariabelle's Dreams. Based on advice from Luisa's sister, an accountant, the three form a partnership. Luisa owns 40% and Lois and Lucy each own 30%. For the year, Mariabelle's Dreams reports the following:  What amount will Mariabelle's Dreams report to Luisa as her ordinary income from the partnership?

What amount will Mariabelle's Dreams report to Luisa as her ordinary income from the partnership?

A) $54,000

B) $54,400

C) $54,800

D) $55,600

E) $ 56,000

Correct Answer:

Verified

Q2: Which of the following items are included

Q3: Although nontaxable income and nondeductible expenditures are

Q4: When a partner receives a cash distribution

Q5: Since Wisher, Inc. owns 80% of Patriot,

Q11: When a partnership distributes property that has

Q12: Joline operates Adventure Tours as a sole

Q14: Withdrawals of cash by a partner are

Q15: A corporation may reduce trade or business

Q16: A family entity combines the tax-planning aspects

Q20: At the beginning of the current year,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents