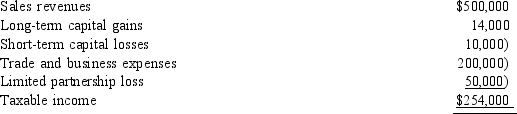

Martin and Joe are equal partners in Ferrell Company. For the current year, Ferrell Company reports the following items of income and expense:  In addition to his Ferrell Company earnings, Martin has other income of $35,000. Included in the $35,000 is a $10,000 loss from the sale of land held as an investment. Martin's adjusted gross income is:

In addition to his Ferrell Company earnings, Martin has other income of $35,000. Included in the $35,000 is a $10,000 loss from the sale of land held as an investment. Martin's adjusted gross income is:

A) $162,000

B) $167,000

C) $172,000

D) $187,000

E) $192,000

Correct Answer:

Verified

Q1: Sales of property between a partner who

Q2: Which of the following items are included

Q7: Corporations that sell depreciable real property are

Q8: The amount of the dividend on a

Q12: When a corporation pays a dividend, it

Q13: With the exception of personal service and

Q17: A partner's basis is increased by the

Q21: rvin's adjusted basis in the Gamma Partnership

Q34: During the current year,Campbell Corporation receives dividend

Q36: Ed's adjusted basis in his partnership interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents