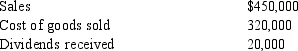

During the current year, Metcalf Corporation has the following items of income and expense:  Metcalf owns 37% of the corporation that distributed the dividend to Metcalf. Determine the amount reported as income before special deductions for the current year.

Metcalf owns 37% of the corporation that distributed the dividend to Metcalf. Determine the amount reported as income before special deductions for the current year.

A) $130,000

B) $134,000

C) $150,000

D) $454,000

E) $470,000

Correct Answer:

Verified

Q41: Valmont owns 98% of the stock of

Q49: Abaco Corp. has gross income of $230,000

Q52: Sean Corporation's operating income totals $200,000 for

Q52: Pluto Corporation contributes $30,000 to qualified charitable

Q53: Virginia is the sole shareholder in Barnes

Q54: Rona owns 3% of Theta Corporation and

Q55: A corporation's excess charitable contributions over the

Q56: During the current year, Hope Corporation has

Q57: Lane Inc., an electing S corporation, realizes

Q60: Bronco Corporation realizes $270,000 from sales during

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents