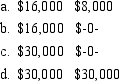

Global Corporation distributes property with a basis of $22,000 and a fair market value of $30,000 to Arturo in complete liquidation of the corporation. Arturo's basis in the stock is $14,000. What must Arturo and Global report as income upon the liquidation of Global? Arturo Global

Correct Answer:

Verified

Q42: A corporation's calculation of the maximum allowable

Q46: During the current year,Timepiece Corporation has operating

Q50: Carlota owns 4% of Express Corporation and

Q61: Roy receives a nonliquidating distribution from Ageless

Q64: The Serenity Corporation distributes $200,000 in cash

Q65: Lavery Corporation has two equal shareholders, and

Q70: Boston Company, an electing S corporation, has

Q71: Anna owns 20% of Cross Co., an

Q78: Meritt is a partner in the McPherson

Q79: Pablo owns 30% of Cancun Company, an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents