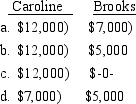

Brooks Corporation distributes property with a basis of $20,000 and a fair market value of $25,000 to Caroline in complete liquidation of the corporation. Caroline's basis in the stock is $32,000. What must Caroline and Brooks report as income loss) upon the liquidation of Brooks?

Correct Answer:

Verified

Q63: Howard is a partner in the Smithton

Q69: During the current year the Newport Partnership

Q72: Peter owns 30% of Bear Company, an

Q73: On a nonliquidating distribution of cash from

Q74: Byron is a partner in the Dowdy

Q76: Mariana is a partner in the Benson

Q77: hance Corporation has a $20,000 deficit in

Q78: osey Corporation distributes land with a fair

Q79: Micaela owns all the shares of the

Q80: Fender Corporation makes a cash distribution of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents