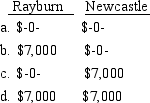

Rayburn owns all the shares of Newcastle Corporation that operates as an S corporation. Rayburn's basis in the stock is $15,000. During the year he receives a cash distribution of $22,000 from Newcastle. What must Rayburn and Newcastle report as income from the cash distribution?

Correct Answer:

Verified

Q63: Howard is a partner in the Smithton

Q69: During the current year the Newport Partnership

Q77: hance Corporation has a $20,000 deficit in

Q78: osey Corporation distributes land with a fair

Q79: Micaela owns all the shares of the

Q81: Malcolm receives a liquidating distribution of land

Q82: Calvin Corporation, has the following items of

Q85: Mario receives a liquidating distribution of land

Q86: Dorothy operates a pet store as a

Q93: Discuss two tax-planning techniques that can be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents