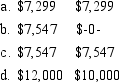

Jim, age 71, is a single taxpayer who retired from his job at the Lansing Corporation in 2013. On January 1, 2014, when he begins to receive his annuity distribution, the value of his pension plan assets is $200,000 and his basis is zero. What amount must Jim receive in 2014 and how much of the amount he receives is taxable? Required Amount Distribution Taxable

Correct Answer:

Verified

Q21: Concerning individual retirement accounts (IRAs),

I.A single taxpayer

Q25: A Keogh plan is a type of

Q39: Jose is an employee of O'Hara Industry

Q42: The Rector Corporation maintains a SIMPLE-IRA retirement

Q44: A qualified distribution from a Roth IRA

Q44: Ann is the sole owner of a

Q46: On May 10, 2012, Rafter Corporation granted

Q47: A company that maintains a SIMPLE-401k) has

Q48: On May 21, 2012, Becker Corporation granted

Q53: Amanda is an employee of the Kiwi

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents