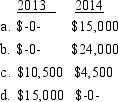

On January 22, 2012, Dalton Corporation granted Kathleen an option to acquire 1,500 shares of the company's stock for $7 per share. The fair market price of the stock on the date of grant was $13. The stock requires that Kathleen remain with the company for one year after the date of exercise. The option did not have a readily ascertainable fair market value. Kathleen exercises the option on August 10, 2013, when the fair market value of the stock is $17. She makes a Section 83 b) election at the exercise date. On August 10, 2014, the fair market value of the stock is $23 per share. How much must she report as income in 2013 and 2014

Correct Answer:

Verified

Q59: Contributions to a Roth IRA: I. May

Q60: On May 5, 2012, Elton Corporation granted

Q62: Kelly purchases a warehouse for her sole

Q63: On October 2, 2014, Miriam sells 1,000

Q63: To obtain the rehabilitation expenditures tax credit

Q64: Dunn Company bought an old building in

Q65: In 2009, Merlin received the right to

Q66: Hillside Group, a partnership, purchased a building

Q66: Which of the following itemized deductions is

Q67: On October 23, 2014, McIntyre sells 700

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents