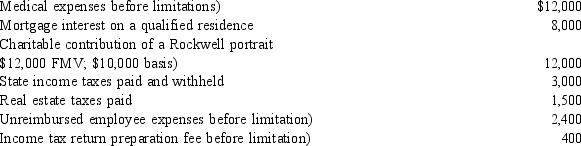

Eileen is a single individual with no dependents. Her adjusted gross income for 2014 is $60,000. She has the following items that qualify as itemized deductions. What is the amount of Eileen's AMT adjustment for itemized deductions for 2014?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: When calculating AMTI, individual taxpayers must add

Q82: Cary is an employee with the Bayview

Q82: Jane is a partner with Smithstone LLP.

Q86: On January 3, 2014, Great Spirit Inc.,

Q89: Coffin Corporation (a domestic corporation)has $200,000 of

Q94: For the current year, Salvador's regular tax

Q98: Which of the following is (are)AMT tax

Q99: Gilberto is a Spanish citizen living in

Q100: Sylvester is a U.S. citizen living in

Q107: Drew is a partner with Peyton LLP.Peyton

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents