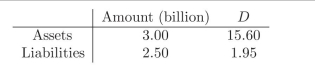

Use a swap to hedge the following Balance Sheet, so that parallel shifts in the term structure don't have an impact on the equity value:  The swap used to hedge is 1.5 year swap, you know the following discount factors:

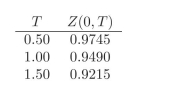

The swap used to hedge is 1.5 year swap, you know the following discount factors:  In order to get the answer, compute the following:

In order to get the answer, compute the following:

i. What is the adequate swap rate?

ii. What is the dollar duration of the swap?

iii. What is the value of equity and its dollar duration, prior to any hedging?

iv. What is the value of notional needed so that the swap position hedges any impact that parallel shifts in the yield curve may have on the value of equity?

Correct Answer:

Verified

i. The adequate swap...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Determine the swap rate for the following

Q2: Use the following table when needed:

Q3: Consider the same swap as in the

Q4: What is the Forward Price to purchase

Q5: Suppose you have entered into the Forward

Q7: You notice that forward rates are below

Q8: Assume that the swap spread at the

Q9: If short term rates go up, what

Q10: What is the value of a swap

Q11: Value a 1.5 year swap, with swap

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents