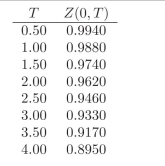

You are given the following discount factors:  You are told that the price of a European Call option on a 2-year ?xed rate bond paying 5% semiannually, with T =2andK = 101 is 4.6155. While the price of a European Put option with the exact same speci?cation is: 3.0500. Are the securities adequately priced?

You are told that the price of a European Call option on a 2-year ?xed rate bond paying 5% semiannually, with T =2andK = 101 is 4.6155. While the price of a European Put option with the exact same speci?cation is: 3.0500. Are the securities adequately priced?

Correct Answer:

Verified

Q1: What is a European Put option?

Q2: What are the main di?erences between a

Q4: You are given the following discount factors:

Q5: What is the difference between a European

Q6: What is an American Put option?

Q7: What will be the value of a

Q8: What does mark-to-market mean?

Q10: What are the shortcomings of futures, when

Q11: What is a European Call option?

Q92: What is a margin call?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents