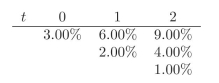

You are given the following interest rate tree. Use it when required in the

exercises.

-What advantage does the Black-Derman-Toy model have over the Ho-Lee model, when comparing the plausibility of the modeled interest rates?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Suppose you want to hedge the cap

Q8: In the context of the futures market,

Q9: What is the difference between flat volatility

Q10: What is the difference between empirical volatility

Q11: Does empirical σ (based on past realizations)

Q13: You find that the Black-Derman-Toy model predicts

Q14: If you use caps and bonds to

Q15: Assume that after you estimate the risk

Q16: Assume that after you estimate the risk

Q17: Assume that after you estimate the risk

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents