Grenada Company is contemplating the acquisition of a machine that costs $50,000 and promises to reduce annual cash operating costs by $11,000 over each of the next six years.

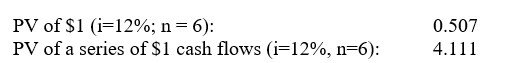

Which of the following is a proper way to evaluate this investment if the company desires a 12% return on all investments?

A) $50,000 versus - $11,000 * 6.

B) $50,000 versus - $66,000 * 0.507.

C) $50,000 versus - $66,000 * 4.111.

D) $50,000 versus - $11,000 * 4.111.

E) $50,000 *0.893 versus - $11,000 * 4.111.

Correct Answer:

Verified

Q28: A machine costs $25,000; it is expected

Q29: The decision process that has managers select

Q30: The hurdle rate that is used in

Q31: Which of the following is taken into

Q32: A new asset is expected to provide

Q34: In a net-present-value analysis, the discount rate

Q35: The true economic yield produced by an

Q36: A company that is using the internal

Q37: The internal rate of return:

A) ignores the

Q38: Barton Company can acquire a $900,000 machine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents