Barton Company can acquire a $900,000 machine now that will benefit the firm over the next 6 years.

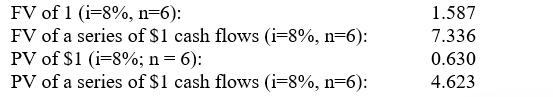

Annual savings in cash operating costs are expected to total $190,000. If the hurdle rate is 8%, the investment's net present value is:

A) $(181,800) .

B) $(21,630) .

C) $44,970.

D) $184,920.

E) None of the answers is correct.

Correct Answer:

Verified

Q33: Grenada Company is contemplating the acquisition of

Q34: In a net-present-value analysis, the discount rate

Q35: The true economic yield produced by an

Q36: A company that is using the internal

Q37: The internal rate of return:

A) ignores the

Q39: Carlin Company, which uses net present value

Q40: The mayor of Trenton is considering the

Q41: Generally speaking, which of the following would

Q42: The rule for project acceptance under the

Q43: Consider the following statements about the total-cost

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents