A machine is expected to produce annual savings in cash operating costs of $400,000 for the next six years.

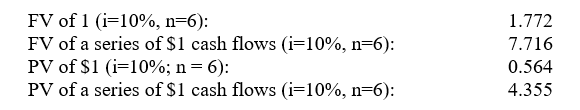

If the company has a 10% after-tax hurdle rate and is subject to a 30% income tax rate, the correct discounted net cash flow would be:

A) $522,600.

B) $947,520.

C) $1,219,400.

D) $1,742,000.

E) None of the answers is correct.

Correct Answer:

Verified

Q73: In eight years, Shu Company plans to

Q74: A company used the net-present-value method to

Q75: Young Company received $18,000 cash from the

Q76: Donata Company purchased equipment for $30,000 in

Q77: Julio Company purchased a $200,000 machine that

Q79: A company that uses accelerated depreciation:

A) would

Q80: Use the following information to answer the

Q81: When making investment decisions that involve advanced

Q82: Barrel Corporation, which is subject to a

Q83: Krate Inc. is considering a $600,000 investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents