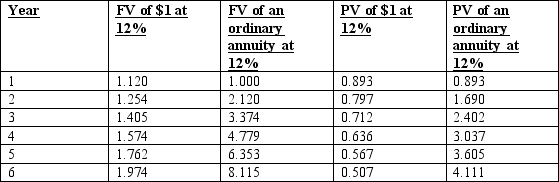

A new machine is expected to produce a MACRS deduction in three years of $50,000.

If the company has a 12% after-tax hurdle rate and is subject to a 30% income tax rate, the correct discounted net cash flow to include in an acquisition analysis would be:

A) $0.

B) $10,680.

C) $24,920.

D) $46,280.

E) None of the other answers is correct.

Correct Answer:

Verified

Q64: A depreciation tax shield is a(n):

A) after-tax

Q65: The Modified Accelerated Cost Recovery System (MACRS)

Q66: In 10 years, Hopkins Company plans to

Q67: Which of the following is the proper

Q68: A machine was sold in December 20x3

Q70: A company used the net-present-value method to

Q71: If a company desires to be in

Q72: Use the following information to answer the

Q73: In eight years, Shu Company plans to

Q74: A company used the net-present-value method to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents