Randi Corp. is considering the replacement of some machinery that has zero book value and a current market value of $2,800. One possible alternative is to invest in new machinery that costs $30,000. The new equipment has a four-year service life and an estimated salvage value of $3,500, will produce annual cash operating savings of $9,400, and will require a $2,200 overhaul in year 3. The company uses straight-line depreciation.

Required:

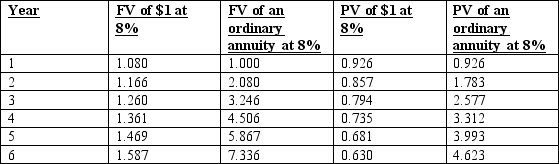

Prepare a net-present-value analysis of Randi’s replacement decision, assuming an 8% hurdle rate and no income taxes. Should the machinery be acquired? Note: Round calculations to the nearest dollar.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: A profitability index can be used to

Q104: Marker Sail Company plans to purchase $4.5

Q105: An increased number of companies are investing

Q106: The payback method is a popular way

Q107: Marcus & Tyler sells frozen custard and

Q109: Kansas Corporation is reviewing an investment proposal

Q110: Both net present value (NPV) and the

Q111: Clear Skies Airline Company is planning a

Q112: On January 2, 20x1, Jennifer Grey purchased

Q113: Racer Industries is currently purchasing Part No.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents