Marker Sail Company plans to purchase $4.5 million of equipment in the not-too-distant future. The equipment will be depreciated by the optional straight-line method over the MACRS life of 5 years. Marker is subject to a 30% income tax rate.

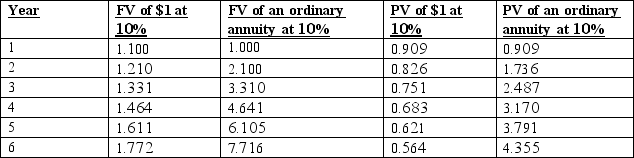

The company's accountant is about to perform a net-present-value analysis, assuming a 10% after-tax hurdle rate.

Required:

A. Determine the discounted cash flows that would be reflected in the analysis in year 0 and year 1.

B. Determine the discounted cash flow that would be reflected in the analysis in year 6, assuming that Marker sells the equipment for $450,000,

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q99: Which of the following project evaluation methods

Q100: The accounting rate of return focuses on

Q101: Canton Corporation is considering the acquisition of

Q102: Tanner Corporation is considering the acquisition of

Q103: A profitability index can be used to

Q105: An increased number of companies are investing

Q106: The payback method is a popular way

Q107: Marcus & Tyler sells frozen custard and

Q108: Randi Corp. is considering the replacement of

Q109: Kansas Corporation is reviewing an investment proposal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents