Tanner Corporation is considering the acquisition of a new machine that is expected to produce annual savings in cash operating costs of $30,000 before income taxes. The machine costs $100,000, has a useful life of five years, and no salvage value. Tanner uses straight-line depreciation on all assets, is subject to a 30% income tax rate, and has an after-tax hurdle rate of 8%.

Required:

A. Compute the machine's accounting rate of return on the initial investment.

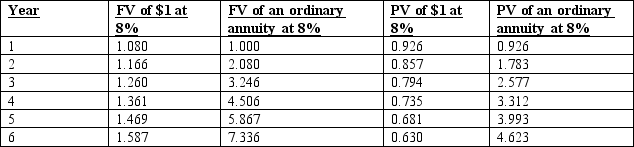

B. Compute the machine's net present value.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q97: A piece of equipment costs $30,000, and

Q98: A cash flow measured in nominal dollars

Q99: Which of the following project evaluation methods

Q100: The accounting rate of return focuses on

Q101: Canton Corporation is considering the acquisition of

Q103: A profitability index can be used to

Q104: Marker Sail Company plans to purchase $4.5

Q105: An increased number of companies are investing

Q106: The payback method is a popular way

Q107: Marcus & Tyler sells frozen custard and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents