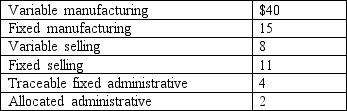

Deltones, a manufacturer of computer peripherals, has excess capacity. The company's Alabama plant has the following per-unit cost structure for item no. 89:

The traceable fixed administrative cost was incurred at the Alabama plant; in contrast, the allocated administrative cost represents a "fair share" of Deltones' corporate overhead. Alabama has been presented with a special order of 5,000 units of item no. 89 on which no selling cost will be incurred. The proper relevant cost in deciding whether to accept this special order would be:

A) $40.

B) $59.

C) $61.

D) $80.

E) None of the answers is correct.

Correct Answer:

Verified

Q39: McAlister Company is operating at capacity and

Q40: The term "opportunity cost" is best defined

Q41: Fairline Skyways has a significant presence at

Q42: Forrest Corporation manufactures parts that are used

Q43: Flavor Enterprises has been approached about providing

Q45: When deciding whether to sell a product

Q46: Which of the following statements regarding costs

Q47: Canyon Trails is studying whether to outsource

Q48: Elkhart, a division of Indiana Enterprises, currently

Q49: Product costs incurred after the split-off point

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents