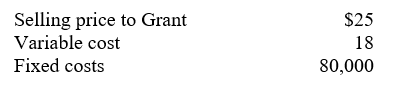

Clariton Corporation has two divisions, Kissimmee and Grant, and evaluates management on the basis of return on investment. Kissimmee currently makes a part that it sells to both Grant and outsiders. Selected data follow.

Kissimmee is seeking an increase in its selling price to $28 per unit because of rising costs. Grant can obtain comparable units from an outside supplier for $26; however, if Grant uses the supplier, Kissimmee will have idle capacity because of an inability to increase sales to outsiders. From the perspective of Clariton Corporation:

A) Kissimmee should continue to do business with Grant and charge $28 per unit.

B) Kissimmee should continue to do business with Grant and charge $25 per unit.

C) Kissimmee should continue to do business with Grant because Kissimmee's variable cost per unit is only $18.

D) Grant should do business with the outside supplier.

E) Grant should split its business between Kissimmee and the outside supplier.

Correct Answer:

Verified

Q75: Use the following information to answer the

Q76: Which of the following transfer-pricing methods can

Q77: The income calculation for a division manager's

Q78: Use the following information to answer the

Q79: A general calculation method for transfer prices

Q81: Carson, Inc., which produces electronic parts in

Q82: The following data pertain to Caldron Corporation:

Q83: Neosho Corporation's Gauge Division manufactures and sells

Q84: One element of the general transfer-pricing rule

Q85: Ragtime Division, which is part of Conquer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents