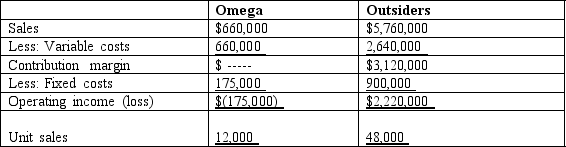

Gamma Division of Fava Corporation produces electric motors, 20% of which are sold to Fava's Omega Division and 80% to outside customers. Fava treats its divisions as profit centers and allows division managers to choose whether to sell to or buy from internal divisions. Corporate policy requires that all interdivisional sales and purchases be transferred at variable cost. Gamma Division's estimated sales and standard cost data for the year ended December 31, based on a capacity of 60,000 units, are as follows:

Gamma has an opportunity to sell the 12,000 units shown above to an outside customer at $80 per unit. Omega can purchase the units it needs from an outside supplier for $92 each.

Required:

A. Assuming that Gamma desires to maximize operating income, should it take on the new customer and discontinue sales to Omega? Why? (Note: Answer this question from Gamma's perspective.)

B. Assume that Fava allows division managers to negotiate transfer prices. The managers agreed on a tentative price of $80 per unit, to be reduced by an equal sharing of the additional Gamma income that results from the sale to Omega of 12,000 motors at $80 per unit. On the basis of this information, compute the company's new transfer price.

Correct Answer:

Verified

Q91: Return on investment (ROI) is a very

Q92: Sierra Corporation is a multi-divisional company whose

Q93: Roger Corporation produces goods in the United

Q94: The following data pertain to Napal Company

Q95: Compuwork Corporation is organized in three separate

Q97: Return on investment (ROI) and residual income

Q98: The following data pertain to the Ouster

Q99: Consider the following data of Twisted Corporation's

Q100: Valient, Inc. has a Pennsylvania-based division that

Q101: What are the three objectives of internal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents