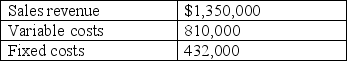

Samuels, Inc. is subject to a 40% income tax rate. The following data pertain to the period just ended when the company produced and sold 45,000 units:

How many units must Samuels sell to earn an after-tax profit of $180,000?

A) 42,000.

B) 45,000.

C) 51,000.

D) 61,000.

E) None of the answers is correct.

Correct Answer:

Verified

Q77: Elise Corporation has the following sales mix

Q78: Flower Depot, Inc. sells a single product

Q79: Morgan Technologies sells a single product at

Q80: Santa Fe Production sells a single product

Q81: The following information relates to Paternus Company:

Q83: The information that follows was obtained from

Q84: Calle Company is studying the impact of

Q85: Downtown Industries recently sold 70,000 units, generating

Q86: Use the following information to answer the

Q87: Which of the following calculations can be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents