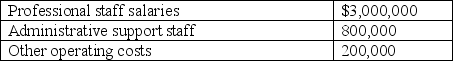

Farmington and Associates designs relatively small sports stadiums and arenas at various sites throughout the country. The firm's accountant prepared the following budget for the upcoming year:

Eighty percent of professional staff salaries are directly traceable to client projects, a figure that falls to 60% for the administrative support staff and other operating costs. Traceable costs are charged directly to client projects; nontraceable costs, on the other hand, are treated as firm overhead and charged to projects by using a predetermined overhead application rate.

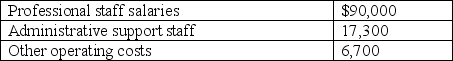

Farmington had one project in process at year-end: an arena that was being designed for Toll County. Costs directly chargeable to this project were:

Required:

A. Determine Farmington's overhead for the year and the firm's predetermined overhead application rate. The rate is based on costs directly chargeable to firm projects.

B. Compute the cost of the Toll County arena project as of year-end.

C. Present three examples of "other operating costs" that might be directly traceable to the Toll County project.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Margin Call, Inc., which uses a job-costing

Q86: Pincus Corporation, which uses a job-costing system,

Q87: Farnham & Associates is a literary consulting

Q88: Layman, Inc., has just completed job nos.

Q89: Altman Corporation uses a job-cost system and

Q90: Describe the types of manufacturing environments that

Q92: Kwik Products uses a predetermined overhead application

Q93: Manufacturing overhead is applied to production.

A. Describe

Q94: Bonanza Enterprises provides consulting services and uses

Q95: Bartlett Corporation, which began operations on January

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents