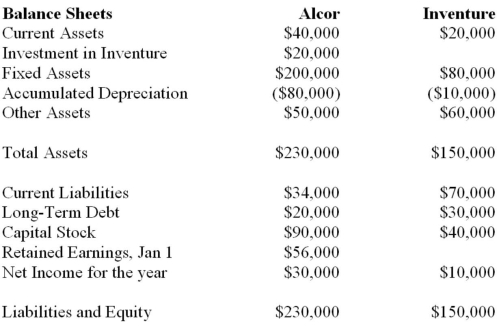

Alcor and Vax Inc, both Canadian private companies, formed a joint venture on January 1, 2013 called Inventure Inc. Alcor and Vax each hold a 50% in the venture and share equally in any profits or losses arising from the venture. The following statements were prepared on December 31, 2013.  Other Information: During 2013, Inventure purchased $10,000 from Alcor. Alcor recorded a gross profit of $2,000 on these sales. On December 31, 2013, Inventure's inventories contained half of the merchandise purchased from Alcor. Alcor uses the cost method to account for its Investment in Inventure and has elected to report its investment using proportionate consolidation. An income tax allocation rate of 20% applies. Compute the Consolidated Net Income for 2013. Do not prepare an Income Statement.

Other Information: During 2013, Inventure purchased $10,000 from Alcor. Alcor recorded a gross profit of $2,000 on these sales. On December 31, 2013, Inventure's inventories contained half of the merchandise purchased from Alcor. Alcor uses the cost method to account for its Investment in Inventure and has elected to report its investment using proportionate consolidation. An income tax allocation rate of 20% applies. Compute the Consolidated Net Income for 2013. Do not prepare an Income Statement.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: When sales to a single customer amount

Q49: Which of the following concerning the distinction

Q51: Alcor and Vax Inc, both Canadian private

Q52: JNG Corp has 4 segments, the details

Q53: JNG Corp has 4 segments, the details

Q54: The implied value of a VIE at

Q55: The following balance sheets have been prepared

Q55: Under which accounting standards is the reporting

Q58: Alcor and Vax Inc, both Canadian private

Q61: X Ltd. and Y Ltd. formed a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents