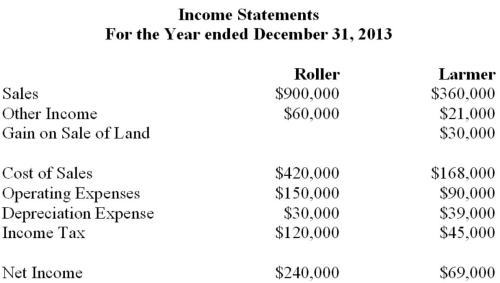

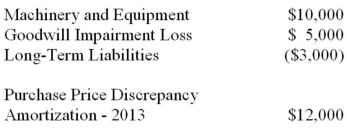

The following are the 2013 Income Statements of Roller Corp and Larmer Corp.  Other Information: During 2013 Larmer paid dividends of $24,000. Roller acquired its 30% stake in Larmer at a cost of $400,000 and uses the cost method to account for its investment. The acquisition differential amortization schedule showed the following write-off for 2013:

Other Information: During 2013 Larmer paid dividends of $24,000. Roller acquired its 30% stake in Larmer at a cost of $400,000 and uses the cost method to account for its investment. The acquisition differential amortization schedule showed the following write-off for 2013:  During 2013, Larmer paid rent to Roller in the amount of $12,000, which Roller has recorded as other income. In 2012, Roller sold Land to Larmer and recorded a profit of $10,000 on the sale. During 2013, Larmer sold the land to a third party. Both companies are subject to a 40% tax rate. Required: Prepare Roller Inc's 2013 income statement, assuming that Larmer is considered to be a joint venture and is reported using the equity method.

During 2013, Larmer paid rent to Roller in the amount of $12,000, which Roller has recorded as other income. In 2012, Roller sold Land to Larmer and recorded a profit of $10,000 on the sale. During 2013, Larmer sold the land to a third party. Both companies are subject to a 40% tax rate. Required: Prepare Roller Inc's 2013 income statement, assuming that Larmer is considered to be a joint venture and is reported using the equity method.

Correct Answer:

Verified

Q40: John Inc and Victor Inc for its

Q41: JNG Corp has 4 segments, the details

Q43: The following balance sheets have been prepared

Q44: Alcor and Vax Inc, both Canadian private

Q45: Globecorp International has six operating segments,

Q46: The following balance sheets have been prepared

Q49: The following balance sheets have been prepared

Q50: ABC Inc. has acquired all of the

Q52: JNG Corp has 4 segments, the details

Q58: Which of the following statements is correct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents