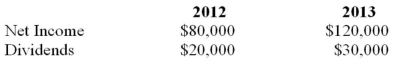

Rin owns 90% of Stempy Inc. On January 1, 2012, the investment in Stempy account had a chapters) valued at $200,000 and $100,889 respectively. Moreover, the assets to which the unamortized acquisition differential relates had a remaining life of 10 years on that date. Rin uses the equity method to account for its investment in Stempy. Rin sold depreciable assets to Stempy on January 1, 2012 at an after-tax gain of $10,000. On January 1, 2013, Stempy sold depreciable assets to Rin at an after-tax gain of $20,000. Both assets are being depreciated over 10 years. Stempy's Net Income and Dividends for 2012 and 2013 are shown below.  What is the amount of the amortization of the acquisition differential during 2013?

What is the amount of the amortization of the acquisition differential during 2013?

A) $7,200.

B) $8,800.

C) $10,000.

D) $80,000.

Correct Answer:

Verified

Q12: Duff Inc. owns 75% of Paddy Corp.

Q13: Rin owns 90% of Stempy Inc. On

Q14: Jay Inc. owns 80% of Tesla Inc.

Q15: King Corp. owns 80% of Kong Corp.

Q16: King Corp. owns 80% of Kong Corp.

Q18: Rin owns 90% of Stempy Inc. On

Q19: Jay Inc. owns 80% of Tesla Inc.

Q20: Duff Inc. owns 75% of Paddy Corp.

Q21: King Corp. owns 80% of Kong Corp.

Q22: King Corp. owns 80% of Kong Corp.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents